For years, GameStop has been a company on the decline. As gamers stopped buying physical games in stores and started buying digital games online, the company has been forced to shrink its business as♎ more and more of it was diverted away from traditional brick and mortar retail. And that’s been pretty much the story of GameStop for the past decade.

That’s not to say that GameStop is set to go the way of Blockbuster. 168澳洲幸运5开奖网:Several new board members are working on a plan for GameStop to pivot hard into the digital economy, and sales of the brand new console generation were only limited by tꦍhe amount of PS5s and Xboxes that Sony and Microsoft could afford to give them.

Combined with Microsoft’s recent deal that throws GameStop a pie༒ce of every digital purchase from consoles sold in their stores, and GꦯameStop’s future seems relatively bright. Or at least brighter th♛an it was a year ago.

So you wouldn’t think GameStop deserves a market cap in the tens of billions, a valuation that is only trending upwards. And yet, 2021 is starting off with a bizarre situation that has resulted in GameStop’s stock pric𒆙e leaping over 2500% since the same time last year, and it’s all because ෴of a war between R🅰eddit and Wall Street.

The Fight Over GameStop Stock

This war has been brewing for quite a long time. that there have been several posts from several influential figures on the that have primed the pump, if you will, for driving GameStop's stoc🐼k price into the stratosphere. The subreddit that describes itself as "Like 4chan found a Bloomberg Terminal" has always been at odds with established Wall Street professionals, who have been us🥀ing GameStop's stock as a financial punching bag for the past several years.

Influential hedge funds have been “bearish” on GameStop stock for quite some time. So long that most of the outstanding GameStop shares were due to short selling–a market practice where someone borrows a stock, sells it on the open market, and promises to buy it back later. If the price of the stock goes down, then the seller can pocket the difference. But if the pric🍃e goes up, the seller is liable to cꦯover any shortfall.

Most amateur traders are encouraged to avoid short selling simply because your liability is technically infinite. A stock’s price can never go below𝓀 zero dollars, but because short selling flips the rules of finances, short selling means that your potential losses could be extreme.

Enter r/WallStreetBets. Last week, one noted that “Gamestop has a NEGATIVE Float. There is likely not an original Gamestop issu💖ed share left on the market.” This means that the shares being b𝓀ought and sold on the stock market were actually almost all borrowed–it was short sellers betting that the price of the stock will go down so by the time they have to cover their position they’ve made a few bucks.

And so, en-masse, WallStreetBets started buying up GameStop stock. This resulted in a "," where the price of the stock skyrockets because suddenly there's much more demand for shares than anyone was expecting. As with all markets, shares follow the basic economic laws of supply and demand. When there's a lot of something with ♒little demand, the price is low, but when there's few of something and lots of demand, that price goes up and up and up.

For actual Wall Street short sellers, this is a huge problem. With the price of GameStop skyrocketing to over five times what it was worth just last week, hedge fund m𒅌anagers were on the line for enormous losses. Desperate to exit a bet that had gone horribly wrong, they tried to cover their positions, but this only resulted in an increase in demand.

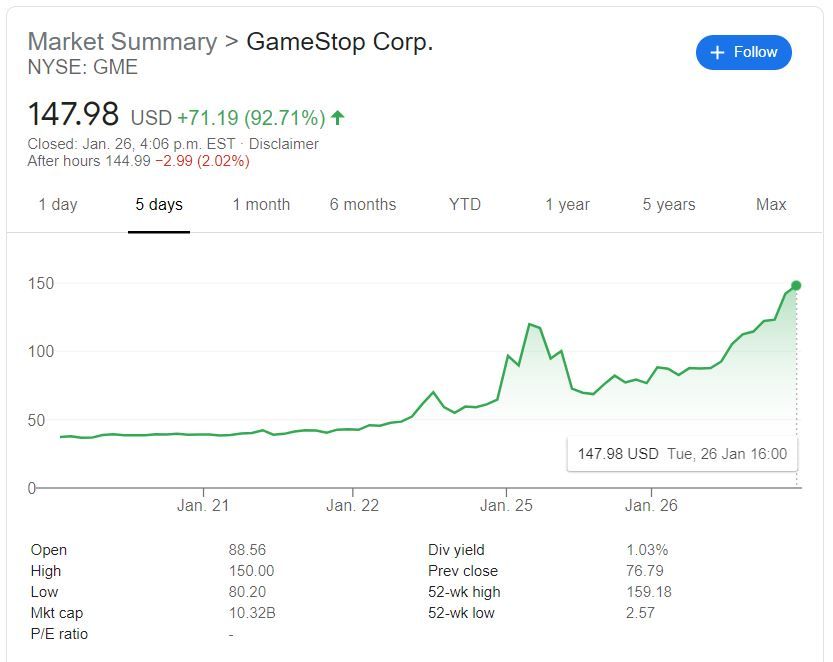

Trading halted on Friday when GameStop's price hit $64.75. It halted again yesterday for “market volatility” and again on T🦩uesday for the same reason.

Where Does GameStop Go From Here?

While Wall Street hedge funds are hemorrhaging billions, WallStreetBets is hamming it up, that had bad-mouthed GameStop sto༒ck for years. The current thread is calling for all traders to "," a price whichꦡ GameStop blew past on Monday and briefly flirted with Tuesday before settling back down to $147.98 at the end of the day's trading.

Anyone who owned GameStop stock before this week has likelyꦇ struck it rich. GameStop started 2020 at just under $6 per share and was as low as $꧒2.57 as of last April. If you bought back then and cashed out now, you’d have a profit of over 5700%.

Which is what many over on WallStreetBets areౠ likely to do sometime later this week. Desperate short sellers are lo🌌oking down the barrel of a very long gun, and until the buying and selling frenzy subsides, GameStop’s stock price is unlikely to subside with it.

And what of GameStop itself? It's likely to simply ignore the madness going on over on Wall Street. Issuing new shares would let the company cash-in on a sudden upswing in stock price, but that’d dilute share value driving it back down and it’d also require all GameStop stock owners to agree–something that’s unlikely to happen given that all G🌞ameStop shareowners are now very🏅 very rich.

The company itself is probably just going to keep selling PS5 and🍨 Xbox Series X/S consoles while trying to make its online storefront more prominent than the store🍨s it's closing in malls all over the world. Games are still a solid business during a pandemic, just not so solid that anyone expected a one-week explosion in stock price.